This week, an American technology company called has experienced an increase once again. Microsoft (MSFT).

By skillfully boosting their share price through artificial means, Microsoft has surpassed Apple as the most valuable company in terms of market capitalization.

How did it succeed in returning to the highest position?

Apple has been focusing on measuring blood oxygen levels in their smartwatches, but Microsoft, on the other hand, has quickly become a leader in various rapidly growing industries such as cloud computing, video games, and artificial intelligence (AI). They have established themselves as a major player, making significant advancements in these fields.

Currently, the dominance of the House of Bill surpasses its competitors, as it has been revitalized by its strong emphasis on the development of generative artificial intelligence (AI). This particular sector has gained more popularity among investors.

Wall Street is optimistic about Microsoft just as it has lost interest in Apple.

Based on a survey conducted by FactSet among analysts on Wall Street, it is revealed that 90% of them currently hold a Buy or Overweight rating for the stock.

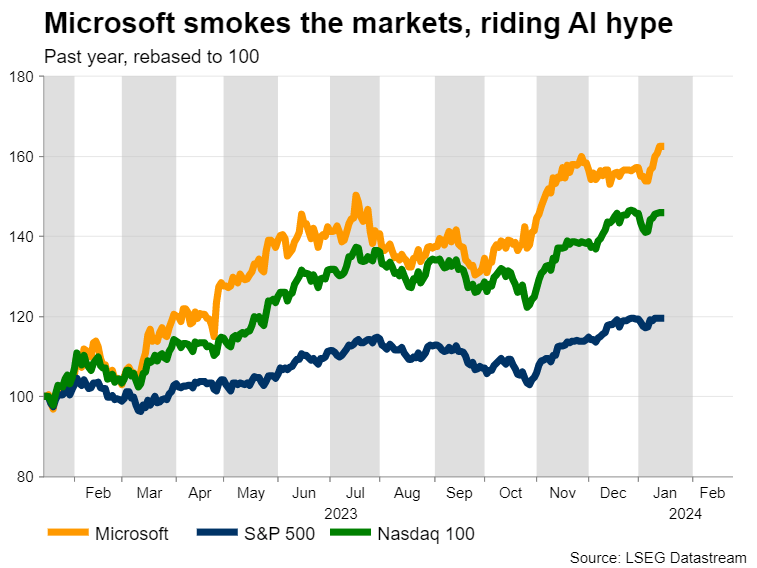

The projected average price suggests a potential increase of 6.2% in the coming year, building on its previous growth of around 60% in 2023.

Wells Fargo has recently made an adjustment to Microsoft’s price target by raising it from US$425 per share to US$435.

The bank anticipates that the company’s already high value will continue to rise, thanks to the significant contribution of artificial intelligence.

On Monday, the bank highlighted that they are observing the development of significant product cycles related to artificial intelligence, which they believe have the potential for further benefits.

At that point, Microsoft’s value reached US$2.887. trillion At its highest point on December 15, Apple’s value reached a record-breaking US$3.081 trillion. However, it has now decreased to a rather embarrassing US$2.875 trillion. .

A seasoned technician’s latest innovation in steering technology.

Apple is relying on technology that is not originally their own, whereas Microsoft has been quick to harness the advancements made by Nvidia, particularly in the field of artificial intelligence which is considered highly innovative in the world of technology.

XM Australia CEO Peter McGuire told Stockhead Microsoft was in a prominent position during the AI revolution as it had a leading role through its controlling ownership of OpenAI, the company responsible for the ChatGPT model, allowing them to witness the advancements as they happened.

Investors are growing more confident that even if the global economy slows down, there will still be a strong demand for AI products. This will protect corporations from suffering any negative effects on their profits caused by overall economic weaknesses.

In the July-September quarter, Microsoft utilized OpenAI’s technology in its range of productivity software, which consequently contributed to the revival of its cloud-computing business.

Microsoft has placed great emphasis on AI in its own operations, making it a prominent aspect of their business. They have revamped their Azure division to become the leading cloud service for companies interested in exploring AI technology.

Furthermore, it has also increased its own market capitalization by an additional one trillion US dollars within the same timeframe.

Earlier this week, the prominent software company introduced an artificial intelligence communication tool. They later transformed it into a more advanced version, prioritizing consumers, and included it in their monthly subscription model. This approach has been successful in consistently profiting from end users.

The timing is perfect for a business that is equally knowledgeable about making money as it is about producing computers.

Microsoft Copilot, an AI chatbot developed by Microsoft (MSFT), has recently been introduced in its new Pro edition.

According to reports, the cost of subscribing to Microsoft Copilot Pro will begin at $20 per month, with this amount recurring every month.

The Gates machine has fully invested in AI, surpassing even Nvidia and Amazon in their efforts. As a result, they have experienced an exciting increase in their stock price over the last year, demonstrating how quickly the AI market can change.

In the past year, MSFT shares have experienced a significant increase of more than 60%, which is more than three times the 20% rise seen in the S&P 500. This growth can be attributed to the recognition from AI enthusiasts who observed MSFT’s early strides in generative technology, demonstrated by their $10 billion investment to acquire a portion of OpenAI’s ChatGPT in late 2022.

Currently, Microsoft holds a 49% stake in OpenAI, which is estimated to be worth $86 billion. This significant investment of $3 billion has helped boost the profile of the renowned company.

During that period, Microsoft quickly began pursuing the monetization of artificial intelligence. They achieved this through a brand called Copilot, which utilizes AI to enhance the effectiveness and efficiency of their productivity software suite.

In the past, Copilot’s price was set at $30 per month.

The abilities of MSFT can influence the outcome. Financial analysts predict that Copilot, priced at $30 per month, could potentially increase Microsoft’s revenue in fiscal year 2025 by up to $9 billion.

Also Read: Bailador Technology Investments well-positioned for growth in H2 FY24

Boom gate: MSFT enters a new phase

Experts are making comparisons between the dot.com boom in the early 2000s, a time when internet companies took over from consumer and financial firms as the main influencers of market trends.

In addition to investing in OpenAI, Microsoft has allocated a significant amount of money towards research and development. By attracting industry partners and making strategic acquisitions such as LinkedIn and GitHub, Microsoft has expanded its influence and presence.

The effort to incorporate and utilize a large amount of internal data and harness the knowledge in internal AI capabilities has been successful.

In the past year, Nvidia became part of the prestigious group of seven technology companies with a market capitalization of over $1 trillion. During this time, Microsoft has been effectively implementing various AI solutions.

The majority of Microsoft’s customers are businesses looking to enhance their AI capabilities, rather than everyday consumers facing financial difficulties caused by the high cost of living.

The Microsoft stock has experienced a strong surge despite the increasing uncertainty and doubt about interest rates globally, thanks to its ability to bounce back and overcome challenges. This resilience has led to the shares reaching a new all-time high.

More than just a pretty (inter)face

Pete McGuire believes that Microsoft is experiencing a significant increase in profits due to the growing enthusiasm and attention around artificial intelligence.

In relation to this, the market response will be influenced by whether the outcomes are better or worse than what the markets expect, along with any insights provided by management regarding future prospects.

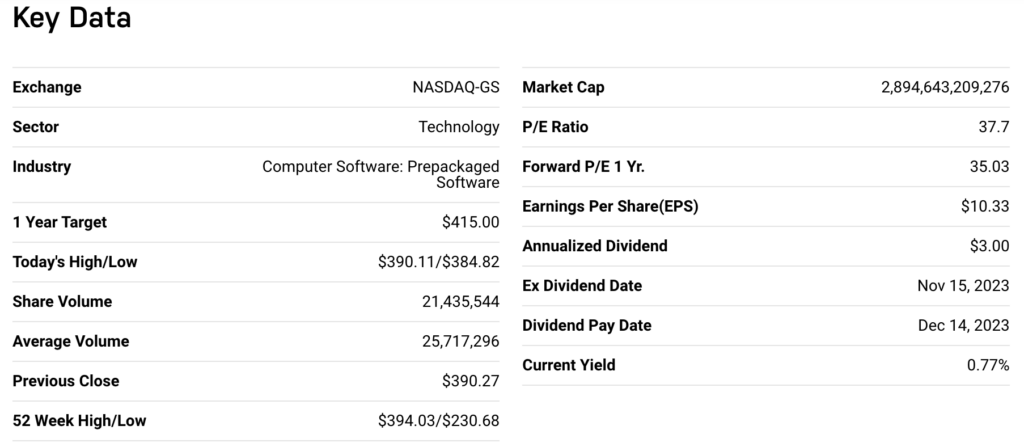

The Street anticipates that Microsoft will announce earnings per share of $2.78 for the fourth quarter of 2023, representing an increase of approximately 20% compared to the same period in the previous year. Likewise, revenue is forecasted to have grown by nearly 16% from the previous year.

“Microsoft has a noteworthy track record of surpassing earnings expectations, which evokes the concept” consistency According to McGuire, Microsoft has consistently achieved positive results in the previous four quarters. As a result, it is highly probable that there will be another unexpected positive outcome, potentially leading to increased demand for Microsoft shares.

MSFT: Technical analysis

According to McGuire, the 400.00 psychological region could potentially be the key area to monitor on the positive side in the charts.

“Looking at the chart (above), Microsoft If the earnings turn out to be worse than expected and surprise positive investors, the shares, which are already being traded at an all-time high, may experience a decrease in value. However, there is a chance that the previous high of 390.00 could act as a barrier to prevent a significant decline in the share price.

“If sellers are able to break through it, attention will then turn to the area around 377.00.”

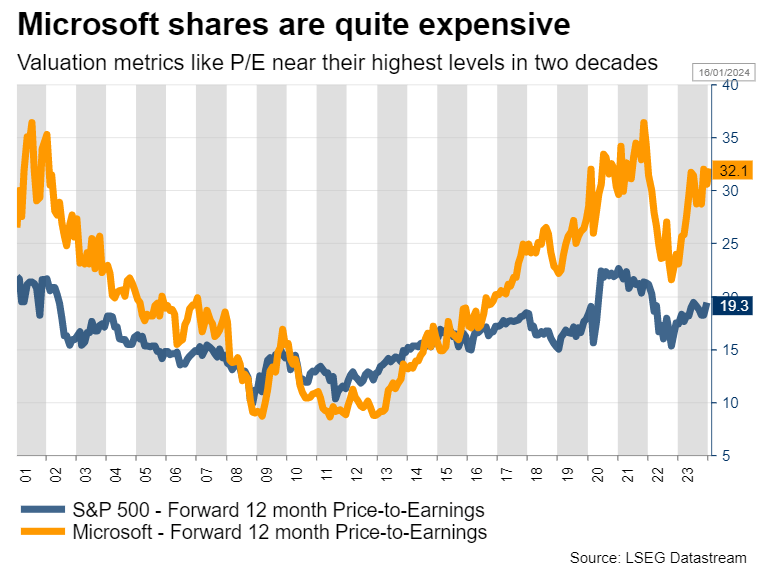

Record mkt cap = Record Valuation

According to McGuire, the main cause for concern regarding Microsoft The paragraph is already in English language. However, if you’re looking for a paraphrase, it could be stated as “Shares have become increasingly costly from a valuation standpoint.”

MSFT: 17th January Close of Trade

a high-growth company, is quite expensive. This implies that the market has high expectations for the company’s future earnings and growth potential. However, some investors may be concerned that the stock is overvalued and may not be able to meet these lofty expectations.” Microsoft is a stretched valuation.”

According to Pete, Microsoft hasn’t traded at a comparable valuation since 2002, when the ‘dot com’ bubble was collapsing, if we exclude the years affected by the pandemic.

Therefore, the stock’s potential for increased value is restricted because the market has already taken into account most of the anticipated future growth, as expectations are already very high.

Overall, Microsoft’s future looks promising as the AI revolution is still in its early phases. However, the stock’s high value already accounts for this positive outlook, indicating that there may be limited room for significant short-term growth.