Special Report: Tech-focused investment firm Bailador Technology Investments is currently in a strong position midway through FY24. Its investments in private companies are strategically positioned for growth.

Strong financial performance in H1 FY24

Bailador Technology Investments (ASX:BTI) is an Australian company that focuses on investing in technology businesses.During the first half of fiscal year 2024, it was reported that the company’s net tangible assets per share, after taxes, along with net dividends distributed, saw a 9.8% growth.

According to Paul Wilson, co-founder and managing partner, the rise in value is attributed to a profit in the post-tax portfolio, which is the difference between investment gains and expenses. This increase amounts to 15 cents per share, after adjusting for a dividend payment of 3.2 cents per share that is fully-franked.

He states that our investments in private companies are still strategically advantageous.

According to Wilson, BTI followed its dividend policy and paid its last dividend of 3.2 cents per share in September 2023. This dividend was fully franked and resulted in an annualized dividend yield of 7.3% when considering franking credits.

The policy of the company is to give a yearly payment of 4% before taxes based on the NTA (Net Tangible Assets), which is split into 2% for the June NTA and 2% for the December NTA. Nonetheless, in the past, the dividend yield that shareholders received has consistently been higher than this.

According to Wilson, the interim dividend suggested by the unaudited pre-tax NTA in December is 3.5 cents per share (fully franked), but this is dependent on the board’s decision. This indicates an annualized grossed-up yield of 7.2% based on Bailador’s shareprice of $1.295 when it was released.

More than 60% return on InstantScripts investments

BTI successfully received $51.6 million in cash from InstantScripts in July 2023, with any additional changes being accounted for in November.

After the acquisition of InstantScripts, it became clear or was realized Wesfarmers (ASX:WES) API, an Australian pharmaceutical company, was acquired for approximately $135 million.

According to Wilson, the understanding was at a price that was 25% greater than its previous recorded value. Additionally, it resulted in a cash internal rate of return (IRR) of 60.9% on the initial investment.

At first, BTI invested $5.5 million in InstantScripts and later added $24.7 million in subsequent investments, showing their strong belief in the company’s future success.

InstantScripts offers services for prescriptions online, telehealth consultations, organizing blood tests, and providing medical certificates.

The platform, which was founded by Dr Asher Freilich and Maxim Shklyar in 2018, has provided services to over 600,000 customers and completed over 1 million consultations.

He states that it was a positive achievement for us to consistently sell our investments for cash at a higher value than what we originally valued them at.

Follow-up investments

BTI gave additional funding to two private portfolio companies during the first half of the fiscal year 2024.

BTI made a $900,000 investment in RC TopCo, a company that was established in December. RC TopCo was created through the merger of Rezdy, Checkfront, and Regiondo, which are global tour and activity operators from Australia & Pacific, Americas, and Europe respectively.

BTI was previously a financial supporter of Rezdy and chose to acquire stock in the newly combined corporation.

Wilson states that they currently possess a notable portion of a prominent global tours and activities software company.

He mentions that during the first half of fiscal year 2024, the team at RC TopCo has been occupied with making necessary changes to their cost structures, emphasizing product development, and aligning their sales and marketing approaches.

He states that they still have board representation on RC TopCo and are satisfied with the progress.

Furthermore, BTI made a financial commitment of $1.57 million by investing in a convertible note with Access Telehealth during the month of December.

According to Wilson, the price of the note is connected to the price of a future transaction and does not affect the value at which BTI currently possesses Access Telehealth.

He says that it had been 12 months since the last third-party transaction in Access Telehealth, as of December.

“In accordance with our valuation policy, we have assessed the value and are delighted to report that Access Telehealth has seen a remarkable 28% increase following a year of impressive performance.”

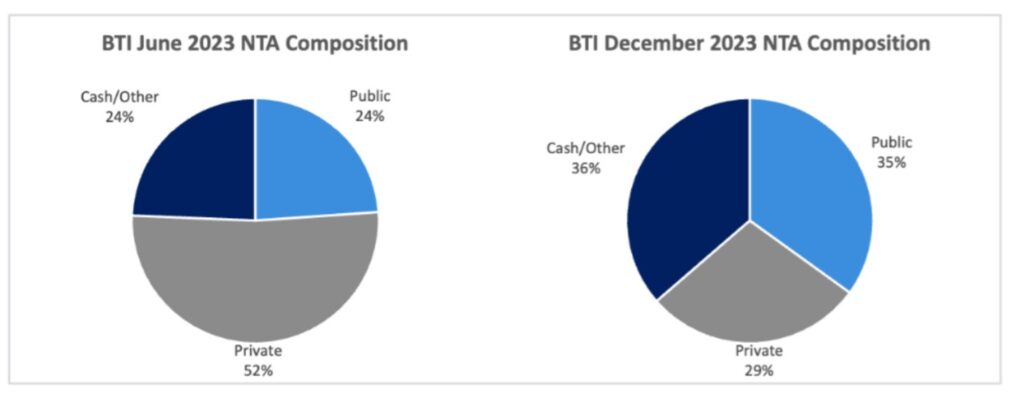

Investment portfolio evenly weighted

Wilson states that the BTI portfolio is presently balanced among private investments, public investments, and cash.

He states that he is content with the current placement and future potential of the companies in the portfolio.

revenue generated from its products and services in the past year is a great achievement for the company. Wilson also mentions that the company has been able to successfully expand its customer base and increase its market share. SiteMinder (ASX:SDR) The main factors responsible for the change in weighting since June 2023 are the share price during the first half of fiscal year 2024.

In CY24, a significant sum of money is anticipated to be invested in private ventures, including both new investments and additional investments.

Public company investments set for growth

According to Wilson, the growth guidance for SDR remains the same, with a focus on achieving a 30% increase in organic revenue over the next few years.

BTI was one of the first investors in SDR, a company that has now emerged as the leading SaaS business globally in connecting hotels with digital distribution channels.

The company still anticipates being profitable in terms of underlying EBITDA and generating positive underlying free cash flow in the second half of the fiscal year 2024.

Wilson says its other public investment Straker (ASX:STR) continues to work on R&D to capture fresh prospects related to artificial intelligence channels .

STR is a dominant player in the AI language services and technology sector. In December 2023, they initiated a program to repurchase company shares, authorizing the acquisition of a maximum of 5% of the total issued capital.

No shares have been sold by BTI for the buyback.

Also Read: Microsoft’s AI ambitions: Can it challenge Nvidia as AI leader?

Confidence in private company investments

In addition to RC TopCo and Access Telehealth, BTI has also invested in Rosterfy, a comprehensive software solution for managing volunteers, which became part of their portfolio in April 2023.

Wilson expresses his belief that the things observed subsequently have reassured him about the soundness of his investment.

“The company is experiencing significant growth and is actively investing in sales and marketing efforts in the United States and the United Kingdom. Additionally, they are recruiting experienced professionals in Australia and are devoted to creating top-notch products that lead the industry worldwide.”

According to Wilson, the reason for their investment in Nosto is because BTI sold Stackla, a smaller digital marketing services business, to Nosto a few years ago.

He mentions that Nosto is still prioritizing the improvement of its product offering by incorporating generative AI features and functionality into their Commerce Experience Platform.

Mosh, a digital platform, offers convenient and top-notch services in the areas of hair loss, weight management, and sexual health for men. Additionally, BTI has invested in Mosh.

Wilson states that Mosh purchased The Healthy Mummy in August in order to enhance its expansion in the field of women’s healthcare.