Now, let’s discuss the well-known company Align Technology, Inc. NASDAQ:ALGN The company’s stock price on NASDAQGS has seen a significant increase in the past few weeks, making it one of the top gainers. While this surge has been positive for the company, it has not yet reached its highest point for the year. Analysts have been closely monitoring the stock, so any important news may have already influenced its price. However, there is a possibility that the stock is currently undervalued. To determine if there is still a good buying opportunity, let’s take a closer look at Align Technology’s valuation and future prospects.

What Is Align Technology Worth?

According to our analysis using the price multiple model, Align Technology appears to be priced higher compared to the industry average. We have used the price-to-earnings ratio as there is limited information available to predict the stock’s cash flows accurately. Align Technology’s ratio of 54.2x is higher than the peer average of 35.81x, indicating that the stock is trading at a premium in the Medical Equipment industry. However, there may be a potential opportunity to buy the stock at a lower price in the future given its volatility. Its high beta suggests that the stock moves more relative to the market, which could result in further fluctuations in its price.

Do you think Align Technology will experience growth in the future?

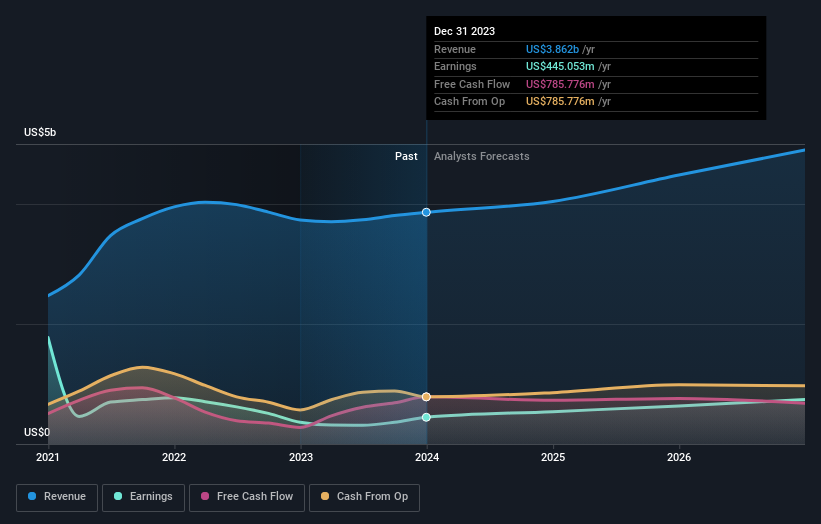

Investors seeking to increase their portfolio value should assess a company’s potential before purchasing its stocks. Investing in a strong company with promising future prospects at a discounted price is a smart decision. Let’s also analyze the company’s projected growth. Align Technology is forecasted to see a 67% increase in earnings in the coming years, suggesting a positive outlook. This is likely to result in higher cash flows and an increase in the company’s stock price.

Also Read: Technology and Teamwork Save Man in Great Broughton: A Race Against the Cold

What This Means For You

Are you a shareholder? The market looks to have already factored in ALGN’s positive future prospects, as its shares are trading at prices higher than those of others in the industry. This raises the question – should you sell now? If you think ALGN’s price should be lower, selling at a high price and buying back when it decreases towards the industry average could be a wise move. However, it’s important to consider if there have been any changes in the company’s fundamentals before making this decision.

Are you someone who is interested in investing?If you have been monitoring ALGN for some time, it may not be advisable to invest in the stock at this moment. The price has exceeded that of its competitors in the industry, indicating that there may not be much room for further increases. Nonetheless, the optimistic forecast for ALGN is promising, so it is recommended to investigate additional factors in order to capitalize on any potential future price declines.